Market Musings - November 6, 2017

- Scott Klarquist

- Nov 6, 2017

- 5 min read

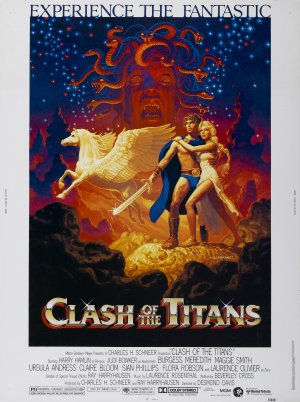

We continue our blog series: Market Musings, Volume 1, Edition 3, giving our (hopefully not too random) thoughts on recent goings-on in the markets. Today, we present Clash of the Titans: Viacom at $24 versus Netflix at $200.

Often people try to justify a company's stock price by resorting to blanket qualitative arguments (e.g., "Netflix will 'own the future' in media distribution, thus current valuation is irrelevant" or "Viacom's business model is susceptible to cord-cutting so its stock should be avoided", etc.) These kind of arguments are, unfortunately, quite imprecise and usually fail to incorporate a key determinant in the buy/sell decision process, namely valuation. It is easy to make a valid (and usually obvious) qualitative argument; however, a company that is a clear buy at one price will always be a clear sell at another (and vice versa). In our view a more appropriate method of answering the buy/sell question is through a bit of reverse engineering. Namely, one should begin with the current valuation and then ask "Under what scenarios will Company X justify today's market or enterprise value?"

Consider Netflix (ticker NFLX) and Viacom (ticker VIAB), for instance. With a market cap of almost $87 billion and an enterprise value (or EV) of $90 billion, NFLX is is currently beloved by investors, and with a market cap of $9.4 billion and an EV of $20 billion, VIAB is currently detested by investors. NFLX's stock has skyrocketed over the past two years, while VIAB's has plummeted. The reasons for this love/hatred dynamic can be found in the qualitative arguments in the immediately preceding paragraph (NFLX will "own the future" and VIAB appears to be "clearly dying"). However, what if investors were instead to ask "Under what scenarios will NFLX justify its current valuation?" and the same for Viacom? Well, let's see...

NETFLIX WHAT-IF SCENARIOS: First take NFLX, which can currently do no wrong in the eyes of the market. Let's assume that investors are correct, that NFLX will enjoy massive revenue and earnings grow far into the future, given its clear lead in streaming content over the Internet to its now 100+ million subscribers. Assume, for instance, that NFLX's earnings grow by a massive 80% from 2017's expected $1.25/share to $2.25/share in 2018, in line with analysts' current expectations; then assume NFLX's earnings continue to grow off of 2018's level by 30% per year through 2025, and then level out to 5% annual growth from 2026 through 2036. These are pretty aggressive earnings growth assumptions by any standard (under this scenario, NFLX's EPS would explode to $14/share in 2025). So what would the value of this 2017-2036 earnings stream be worth, if we discount it back to a net present value (via the "NPV" function in Excel) using a 5% discount rate? Approximately $66 billion, or $23 billion below the current enterprise value and $20 billion below the current market cap. Thus we find, employing our reverse engineering method, that even with these foregoing massive growth assumptions, NFLX has large expected downside from the current market valuation. (Note that the vast majority of a company's value to investors depends on what happens in the next 20 years, rather than years 21+, due to the time value of money as well as the inherent uncertainty in predicting financial results decades into the future.) In fact, in order to justify the market's view on NFLX, we would need to increase the 2019-2025 growth rate from 30% to 37%. So if one believes that NFLX can grow earnings 80% over the next year, 37% annually for 2019-2025 and 5% annually from 2025-2036, then the stock is fairly valued (i.e., there is currently minimal expected upside for investors).

But what happens if we dial back our NFLX growth assumptions just a bit? Let's say that instead of 80% growth in earnings over the next year, it turns out to be just 50%; and instead of 30% growth from 2019-2025, it is just 20%? Leaving the other assumptions the same (i.e., 5% EPS growth from 2026-2036 and a 5% discount rate), we find that NFLX's 2017-2036 earnings stream would be worth just $33 billion, or about 37% of today's enterprise value for the company, indicating huge expected downside for investors buying NFLX at today's $200/share market price. How about 40% growth for 2018 and 15% growth from 2019-2025? This still-impressive earnings stream would be worth just $24 billion in net present value, or just 27% of NFLX's current EV. Looking at the numbers, we see that, from today's "loved" valuation, in most reasonable growth scenarios NFLX has either minimal upside or large expected downside. Not a bullish sign for those buying NFLX at today's prices.

VIACOM WHAT-IF SCENARIOS: Next take VIAB, which investors have heaved overboard with disdain lately. Let's assume that investors are correct, that VIAB will suffer for years from the cord-cutting effect. Assume, for instance, that VIAB's earnings eke out a minor gain from 2017's expected $3.85/share to $4/share in 2018, in line with analysts' current expectations; but then decline from 2018's level by 5% per year through 2025, before finally regaining 3% annual growth from 2026 through 2036. These fairly negative earnings assumptions produce a value for VIAB's 2017-2036 earnings stream of approximately $17 billion, or $43/share (note that this assumes VIAB is able to maintain its current debt levels). In order to shrink to VIAB's current market cap, the company's earnings stream would need to decline 20% (instead of 5%) annually from 2019 to 2025. Of course, the market has rightfully assumed that some of VIAB's earnings will be allocated to permanently reduce debt--and therefore this portion of future earnings should be excluded from the market cap (since it would flow to VIAB debtholders, rather than equityholders). However, employing our reverse engineering method, it would still require an extremely serious and lengthy earnings decline to justify VIAB's low stock price today. Note that it would require just 2% annual earnings growth from current levels (i.e., below the rate of inflation) to cause VIAB's earnings stream through 2036 to exceed the company's current EV. And if VIAB could fairly quickly return to 10% earnings growth for the near- to mid-term (for example, through inclusion on various skinny bundles and/or other means of distribution, such as via telecom companies like Verizon or T-Mobile), then the company's shares should be worth upwards of $60 to $90 (depending on how much debt the company permanently repays). Thus, looking at the numbers, we see that, from today's "hated" valuation, in most reasonable scenarios VIAB has either minimal downside or large expected upside, a bullish sign for those buying VIAB at today's prices.

DISCLOSURE: Long VIAB, short NFLX.

Comments